We Can End Property Taxes

We can end property taxes in Texas by replacing it with a flat, no exemption sales and use tax on all transactions. The end net result for the average household will be about $1,800-2,000 in annual savings, and per capita, about $633 per citizen.

For decades, Texas families have been hit by rising property taxes — an unfair tax on perceived wealth that burdens homeowners directly and renters through higher rents. These taxes fund local services, including schools, cities, counties, and special districts, but they are not inevitable. We can fully abolish all $86.6 billion in 2024 property taxes (1, 2) and replace them with a simple, no-exemptions sales and use tax capped at the current maximum rate of 8.25%. By closing loopholes and reallocating the rate split, local governments would receive the revenue they need while Texans gain real relief.

The Texas Comptroller’s 2025 Tax Exemptions and Tax Incidence report shows current sales tax exemptions total approximately $66.8 billion in foregone revenue (18). Removing all exemptions and shifting the 8.25% rate to 2.7% for the state and 5.55% for local entities (cities, counties, schools, and special districts) generates enough revenue to completely replace property taxes. The result: an average Texas household — whether owning or renting — saves a net $1,800 to $2,000 annually after accounting for the broader sales tax base.

This net figure accounts for increased sales tax on currently exempt items; the gross relief from eliminating property taxes averages about $6,400 per household statewide—higher in areas like District 109 with elevated rates (11, 12). Ending property taxes isn't just possible—it's the pro-family, pro-growth reform Texas needs. By broadening the sales tax base without raising rates, we fund essential services while putting thousands back in families' pockets. In District 109 and across the state, it's time to make housing truly affordable. This reform lowers the cost of living, attracts new businesses, and benefits every Texan regardless of income or wealth, keeping Texas strong for generations to come.

Real Relief for House District 109 Families

House District 109 encompasses vibrant southern Dallas County communities, including Cedar Hill, DeSoto, Lancaster, Glenn Heights, Seagoville, parts of Grand Prairie, and smaller areas like Wilmer, Hutchins, Combine, and Ferris (19).

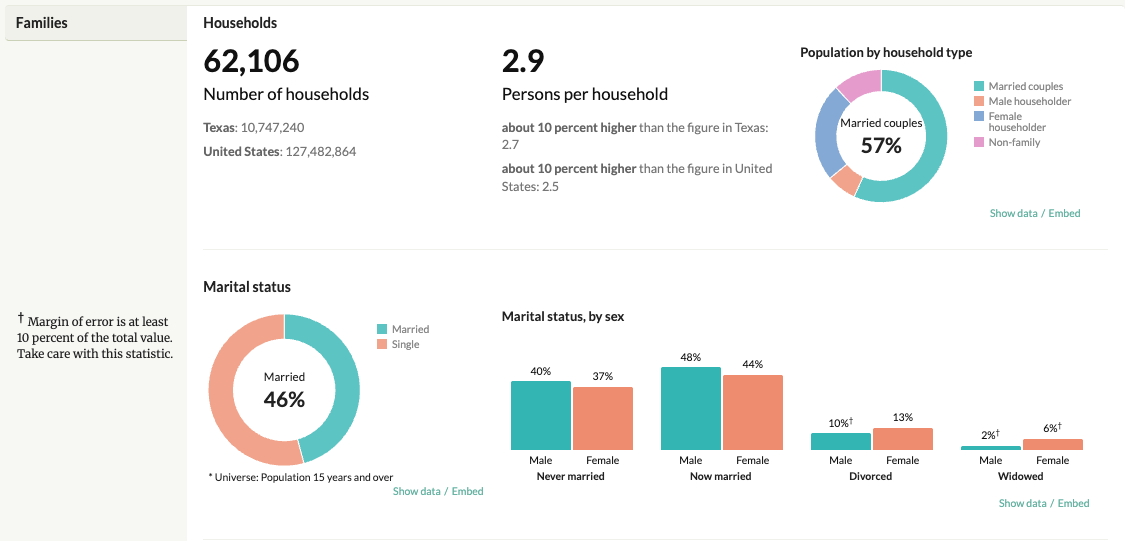

Home to 185,049 residents across 62,106 households, the district is strongly family-oriented: 70.8% of households are families, and 46.2% include children under 18 (19).

Residents here face above-average housing costs in growing suburbs. Average owner-occupied home values sit around $258,000, with typical total property tax rates of 2.3–2.6% (including city, school, county)—leading to annual bills often $5,000–$6,500 for many homeowners (higher than the state average of about $4,100 direct) (7).

Renters (28.5% of households) pay average gross rents of $1,688—well above the state figure—with over half spending 35% or more of income on housing (19). Abolishing property taxes would end these direct bills for owners and allow landlords to lower rents (eliminating the about 17–20% passed-on property tax share) (8, 9, 10).

Statewide, households gain a net $1,800–$2,000 annually after the broader sales tax base. In District 109, the gross savings would likely exceed the state average due to higher local burdens, delivering even stronger relief—potentially $2,500+ net for many families.

This feasible reform, backed by the Comptroller's data showing $66.8 billion in removable exemptions (18), would free up family budgets for essentials like childcare, education, and groceries—making life more affordable right here in HD109 without sacrificing local services.

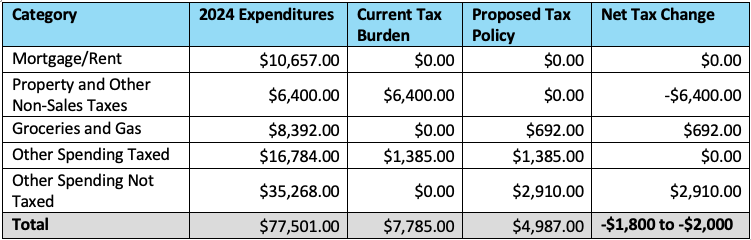

These savings aren't theoretical—they're backed by 2024 data from the Texas Comptroller and Census (1, 2, 19). Here's the breakdown:

Just the Facts.

Property taxes do not fund the state government or its activities. Instead, these annual fees for living somewhere based on perceived value are revenue for city, county, school district, and what are called “special districts.” To demonstrate the impact of replacing property taxes with a no exemption sales and use tax, we’ll use 2024 as a base period for actual numbers. Below is a chart showing the property tax collections for 2024.

· Counties: $15,729,755,794 (18.2%)

· Cities: $15,710,015,039 (18.1%)

· School Districts: $41,657,752,748 (48.1%)

· Special Districts:$13,499,241,657 (15.6%)

· Total: $86,596,765,238

For 2024, the total property taxes collected were $86.6 billion (1, 2). The Texas population in 2024 was about 31.29 million persons (5). The per capita property taxes paid comes out to $2,769 per Texas resident annually. In 2024, the per capita personal income, or PCPI, was $56,621 (4). Thus, property taxes collected was about 4.9% of Texan’s incomes (4).

The Impact on Homeowners vs. Renters, Residential vs. Commercial

Property taxes impact Texans directly (homeowners) and indirectly (renters, via passed-on costs in rent). Approximately 60% of the $86.6 billion total (about $52 billion) falls on residential properties, with the remaining 40% (about $34.6 billion) on commercial/non-residential (10). Of the residential portion, about $32.5 billion is paid directly by homeowners on owner-occupied homes, and about $19.5 billion is passed to renters through higher rent (7, 8, 9, 10).

In 2024, Texas had approximately 10.75 million households, with about 62.6% in owner-occupied homes (5, 6). Homeowner households faced an average direct property tax bill of approximately $4,100 annually (7). Renter households bore an estimated indirect burden of $2,973 per year (midpoint of the 17–20% range applied to median gross rent of $1,339/month), as landlords pass property taxes through higher rent (8, 9). This household-level perspective shows that every Texas family pays property taxes—either directly or indirectly—making abolition a broad affordability win when paired with a no-exemptions sales/use tax.

Putting Into Context of Average Annual Expenditures

To illustrate the scale for typical Texas families, in 2024, the residential portion (about $52 billion) represents a significant household expense per BLS consumer unit standards. Scaled to Texas conditions and averaged across all 10.75 million households, this equates to an illustrative $6,400 annual property tax burden per consumer unit when adjusted for statewide impacts—including both direct bills and passed-on renter costs (11, 12).

Let’s put these numbers into context. Typical annual expenditures in the United States for a “consumer unit” or household has been estimated by the Bureau of Labor Statistics at approximately $77,535 per BLS, scaled to Texas-relevant $77,501 (12). To help us have in context where these property taxes come into play along with typical taxed purchases under the current sales tax, here is a breakdown:

Mortgage/Rent: ~$10,657 (not sales taxed, adjusted to exclude property taxes within rent payments)

Property and other non-sales taxes: ~$6,400 (Adjusted to Texas Property taxes from above per “consumer unit” or household unit.)

Groceries and Gas: ~$8,392 (exempt from sales tax)

Other Spending Taxed: ~$16,784 (currently subject to sales tax)

Other Spending Not Taxed: ~$35,268 (healthcare, pensions, etc.)

The 2024 Sales and Use Tax Collections and Current Exemptions

The above expenditures breakdown illustrates how property taxes represent about 8% fixed household cost—eliminated under this proposal. But what about the trade-off from broadening the sales tax base to no exemptions? The Texas Limited Sales and Use Tax collections for 2024 grand total for all sales tax revenues in fiscal year 2024 (Sept 1, 2023 – Aug 31, 2024) were $47.16 billion for the state, not local.

There is no single press release stating the precise local sales tax revenue collected each year, however based on summing the various monthly distributions an approximate value of $14.71 billion constitutes an official number. These numbers represent a 6.25% sales tax that goes to fund the state government, and an effective 1.95% rate that pays all local entities that benefit from the local sales tax portion, being primarily municipalities/cities (considering that some do not apply the full 2.0% available). (13, 14, 15, 16, and 17)

Now, based on the 2024 data, let’s look at what current Sales and Use Tax exemptions there are, and what their estimated value is. In January of 2025, the comptroller published the Tax Exemptions and Tax Incidence report which provides the valuation of exemptions. For fiscal year 2025 (Sept 1, 2024 to Aug 31, 2025), the total value of sales and use tax exemptions came out to $66.79 billion. This breaks out to about $45.95 billion for the state, and about $20.84 billion for local municipalities. (18)

Applying the Exemptions to Sales Tax and Adjusting Allocations

Given this, what would be the result if we ended all special exemptions for sales taxes, and had sales taxes be applied at 8.25% on all transactions without any exclusions or special carve outs? Using just the numbers we’ve reviewed so far, the result would be:

State Sales Tax revenue would go from current $47.16 billion to $93.11 billion.

$93.11 billion exceeds total “All Funds tax collections” for FY 2025.

Local Sales Tax revenue would go from current $14.16 billion to $35 billion.

This number is based on the effective rate of 2024 at 1.95%, considering not all local beneficiaries of the local portion of sales taxes are applying a full 2.0% sales tax if any at all.

Applying a flat 2.0% rate for all transactions to go to respective local beneficiaries would adjust this to an additional $1.37 billion.

Taking into consideration the fact that property taxes do not go to the state government, but only to the local jurisdictions mentioned earlier, it would be wise to adjust the balance of the current 8.25% tax rate to 2.70% for the state government, and 5.55% for local beneficiaries to replace the value of property taxes. This would adjust local revenues from sales taxes to about $86.1 billion and state revenue to $41.92 billion. This permits for the replacement of the property tax (13-17, 18).

Impact of the Broadened Sales Tax Base on Texas Households

Using the Comptroller's January 2025 report (source 9), current exemptions, exclusions, and discounts total $66.79 billion in foregone revenue for FY2025—primarily consumer items like groceries (~$4.3 billion) and medicines (~$1.1 billion), plus business inputs like raw materials for manufacturing (~$9.7 billion). Removing these at the existing maximum 8.25% rate adds about $66.79 billion to the $61.9 billion current collections (state $47.16B + local about $14.71B), yielding about $128.7 billion total. This fully replaces $86.6 billion in local funding while preserving state revenue neutrality—e.g., reallocating to about 2.7% state share (about $42B revenue) and about 5.55% local share (about $86.6B to local) (1, 2, 13-17, 18).

The broadened base adds new tax on previously exempt consumer spending, but property elimination dominates, delivering net savings:

Per Capita Perspective: Gross property relief about $2,769 per resident offsets additional approximate $2,136 sales burden (scaled from exemptions on resident consumption, adjusted for visitor/business shares), netting about $633 annual savings statewide per person (1, 2, 4, 18).

Household Perspective (BLS Consumer Unit, scaled to about $77,501 Expenditures): Illustrative property burden about $6,400 eliminated vs. new sales about $4,987 proposed (including partial on untaxed categories like medicines), netting about $1,800-2,000 annual savings per household (avg size 2.7 persons) (12, 18).

Renter Perspective: Beyond the household net, renters gain extra $2,500-3,000 in potential annual rent reduction as markets adjust (landlords no longer pass about $19.5B residential property costs), amplifying benefits in renter-heavy areas (8, 9, 10)

This makes living in Texas more affordable, especially for renters in southern Dallas County cities like Cedar Hill and DeSoto, where indirect burdens drop via lower rents (8, 9, 10, 19). Businesses gain too—no rate increase, but exemptions removal on inputs could lower costs, drawing more to Texas. See source 18 for exemptions details, standards for revenue math and expenditures scaling.

For renters, just in reduced rent payments alone there is a potential $2,500-$3,000 annual savings in reduced rent as the market adjusts to not having to pay property taxes any longer (8, 9, 10). Regressivity concerns posited by many academics and elitist individuals are alleviated when the full context of the overall tax policy is taken into consideration. Meaning that for the typical low-income family, there will be a net annual savings by implementing this policy. This brings taxes in the state of Texas to be unlinked from wealth or income making it neutral and dependent solely on the productivity and spending of the population.

Conclusion

There is no legitimate reason for continuing the outdated policy of collecting a property tax when there are better alternatives that don’t put homeownership at risk. Abolishing the property tax can be done without loss of revenue to the state government or local entities. The actual rate would remain unchanged, but simply allocated differently, but all transactions currently exempt would now be taxed to replace the property tax. The result is a net annual savings of about $1,800-2,000 per household (or about $633 per capita, higher in renter heavy areas like District 109) (12, 18, 19). To keep Texas strong, we must abolish property taxes and can do so without endangering the financial independence of our cities, making the cost of living more affordable for Texas families.

Addressing Common Arguments

-

Absolute Dollars vs. Percentage of Income

Tax policy discussions often emphasize regressivity as a higher percentage of income paid by lower-income households. However, in absolute dollars—the actual amount paid—higher-income households spend far more on taxable goods and services. BLS 2024 Consumer Expenditure Survey data shows:

Lowest income quintile (average income ~$15-20k range nationally, adjusted for Texas contexts): Average annual expenditures ~$35,000.

Highest quintile (average income >$200k): Expenditures ~$150,000+.

This pattern holds for currently taxed items and extends to currently exempt categories like groceries. Higher-income households spend more in absolute dollars on food at home (groceries)—often 2-3x the amount of lower-income households—due to larger families, premium choices, or higher overall consumption. Under a no-exemptions sales tax at the capped 8.25% maximum, wealthier Texans would pay significantly more additional tax on these newly taxed items in raw dollars.

Lower-income households, with total expenditures often half (or less) the statewide average of ~$77,500 (scaled from BLS 2024), would face much lower absolute increases in sales tax liability. This directly addresses your point: the wealthy do spend more overall (~75% of income consistently across higher brackets), so they bear more of the tax load in dollars.

Property Taxes' Impact on Renters and Low-Income Texans

For Texans in poverty (13.4% statewide per 2024 Census QuickFacts), the majority rent, and property taxes act as a fixed, passed-through burden—estimated at 17-20% of rent (~$2,640-$3,120 annually at the statewide median gross rent of $1,339). This represents a larger relative hit for low-income renters, as it's not scaled to consumption or ability to adjust spending.

Abolishing the $86.6 billion in 2024 property taxes eliminates this direct pass-through entirely. Landlords, facing no property tax costs, gain incentive and market pressure to lower rents—delivering fixed annual relief of $2,640+ to low-income renters. The replacement no-exemptions sales tax, applied to their lower absolute spending, adds far less in dollars (potentially $400-600 annually on necessities like groceries, based on scaled BLS quintile patterns).

This swap removes a highly regressive fixed cost for vulnerable households while imposing a variable consumption-based one they pay less on absolutely. The net effect: meaningful affordability gains for lower-income Texans, particularly renters.

Statewide and District 109 Context

Statewide, the average household sees gross relief of ~$6,400 (2024 Texas-adjusted property burden per the fixed standards) offset by broader-base sales tax increases, yielding net annual savings of $1,800-$2,000 as calculated in the proposal (accounting for reallocated rates within the 8.25% cap and expanded base generating sustainable local revenue).

In House District 109 (Cedar Hill, DeSoto, Lancaster, Glenn Heights, Seagoville, and parts of southern Dallas County), higher-than-average property tax rates (2.3-2.6%) and gross rents (~$1,688) amplify the gross relief—potentially $5,000-$6,500+ direct for owners and $3,500+ passed-on for renters. This delivers stronger net benefits here, enhancing housing affordability in a family-oriented district (70.8% family households, 46.2% with children under 18).

This reform, grounded in 2024 collections data ($86.6B property vs. ~$61.7B current sales + ~$66.8B foregone from exemptions), funds local services fully while putting real dollars back into Texans' pockets—especially those with lower absolute spending power. It lowers the cost of living, supports families across income levels (with disproportionate renter relief), and positions Texas as more attractive for businesses and residents.

SOURCES

Texas Comptroller of Public Accounts. "Tax Rates and Levies." Texas Comptroller of Public Accounts, 2025, https://comptroller.texas.gov/taxes/property-tax/rates/.

Readers can download each of the files for 2024 pertaining to school district, city, county, and special district tax levies on this page.

Texas Policy Research. "Texas Property Tax Levies 1998–2024." Texas Policy Research, 21 Sept. 2025, https://www.texaspolicyresearch.com/texas-property-tax-levies-1998-2024/.

This website provides a good summary of the data to arrive at the number used in this article, $86.6 billion in collected property tax revenue.

United States, Bureau of Economic Analysis. "Economic Profile for Texas." Bureau of Economic Analysis, 2025, https://apps.bea.gov/regional/bearfacts/.

This website of the US government provides various economic statistics for the state of Texas.

United States, Bureau of Economic Analysis. "BEA, Regional Data, GDP and Personal Income, Texas 2023 Data." Bureau of Economic Analysis, 2025, https://apps.bea.gov/itable/?ReqID=70&step=1#eyJhcHBpZCI6NzAsInN0ZXBzIjpbMSwyOSwyNSwzMSwyNiwyNywzMF0sImRhdGEiOltbIlRhYmxlSWQiLCIxMTAiXSxbIk1ham9yX0FyZWEiLCIwIl0sWyJTdGF0ZSIsWyIwIl1dLFsiQXJlYSIsWyI0ODAwMCJdXSxbIlN0YXRpc3RpYyIsWyItMSJdXSxbIlVuaXRfb2ZfbWVhc3VyZSIsIkxldmVscyJdLFsiWWVhciIsWyIyMDIzIl1dLFsiWWVhckJlZ2luIiwiLTEiXSxbIlllYXJfRW5kIiwiLTEiXV19.

This table shows that in 2023, real per capita personal income in 2017 dollars was $56,621, with real per capita expenditures of $44,666.

United States, Census Bureau. "QuickFacts: Texas, 2024." United States Census Bureau, 2025, https://www.census.gov/quickfacts/fact/table/TX/PST045224.

For general census facts and data for the state of Texas.

United States, Federal Reserve Bank of St. Louis. "Homeownership Rate for Texas." FRED Economic Data, 2025, https://fred.stlouisfed.org/series/TXHOWN.

This provides data on the homeownership rates from the Federal Reserve Bank of St. Louis FRED tool.

SmartAsset. "Texas Property Tax Calculator." SmartAsset, n.d., https://smartasset.com/taxes/texas-property-tax-calculator.

Used for homeowner vs. renter property tax burden data, including average annual bills.

Woolsey, Chris. "Woolsey: Property Taxes’ Impact on Renters." Texas Scorecard, 3 May 2022, https://texasscorecard.com/commentary/woolsey-property-taxes-impact-on-renters/.

Discusses property taxes’ impact on renters.

Saldana, Sean. "What Would Property Tax Relief from the Legislature Mean for Texas Renters?" KUT.org, 31 Jan. 2023, https://www.kut.org/texasstandard/2023-01-31/texas-legislature-property-tax-relief-renters.

Median monthly rent is $1,339 a month. Sources suggest approximately 17-20% of rent, around $220-$260 per month, about $2,640-$3,120 per year.

Texas Taxpayers and Research Association. "The Myth of Texas as a Low Tax State." TTARA, Jan. 2023, https://ttara.org/wp-content/uploads/2023/01/TTARATaxBurdenResearchBrief_1_23.pdf.

This report estimates that businesses pay roughly 60% of all Texas property taxes (including taxes on commercial properties, business personal property, and rental/multifamily properties owned by landlords).

The remaining ~40% is paid directly by individual homeowners on owner-occupied properties.

When combining this with renter impact estimates (where ~17-20% of rent covers property taxes on rental units), the overall burden on Texas residents (direct homeowner payments + passed-on renter costs) approximates 60% of total property taxes, with the pure commercial/non-residential share ~40%.

Texas Comptroller of Public Accounts. "School District Property Value Study, 2024 Final Findings." Texas Comptroller of Public Accounts, Aug. 2025, https://comptroller.texas.gov/taxes/property-tax/pvs/2024f/index.php.

Reference the previously mentioned census data for housing units information and households; used for per-household breakdown of property tax burdens.

United States, Bureau of Labor Statistics. "Consumer Expenditures—2024." Bureau of Labor Statistics, 19 Dec. 2025, https://www.bls.gov/news.release/cesan.nr0.htm.

This shows that average “consumer units” (comparable to a typical household) income before taxes was $104,207. Average annual expenditures were $78,535 (scaled here to Texas-relevant about $77,501 for illustration).

Hegar, Glenn. "Texas Comptroller Glenn Hegar Announces State Revenue for Fiscal 2024, August State Sales Tax Collections." Texas Comptroller of Public Accounts, 3 Sept. 2024, https://comptroller.texas.gov/about/media-center/news/20240903-texas-comptroller-glenn-hegar-announces-state-revenue-for-fiscal-2024-august-state-sales-tax-collections-1725392008875.

Total state revenue from sales tax was $47.16 billion (the 6.25% of current sales tax rate).

Texas Comptroller of Public Accounts. "Acting Comptroller Kelly Hancock Distributes $1.2 Billion in Monthly Sales Tax Revenue to Local Governments." Texas Comptroller of Public Accounts, 10 Dec. 2025, https://comptroller.texas.gov/about/media-center/news/20251210-acting-comptroller-kelly-hancock-distributes-12-billion-in-monthly-sales-tax-revenue-to-local-governments-1765386875219.

Total local portion of sales tax collected was approximately $14.71 billion (the up to 2.00% of current sales tax rate not applied to all localities) as derived from representative monthly data.

Walczak, Jared. "State and Local Sales Tax Rates, Midyear 2025." Tax Foundation, 8 Jul. 2025, https://taxfoundation.org/data/all/state/sales-tax-rates/.

Important to note that average sales tax rate for local is 1.95%.

Texas Comptroller of Public Accounts. "Monthly Sales Tax Allocation Comparison Summary Reports." Texas Comptroller of Public Accounts, 2025, https://comptroller.texas.gov/transparency/local/allocations/sales-tax/.

Can filter to 2024 for each month and municipality summary data.

Texas Comptroller of Public Accounts. "Sales Tax Allocation Dataset." data.texas.gov, 10 Dec. 2025, https://data.texas.gov/dataset/Sales-Tax-Allocation/k2dg-jyxc/about_data.

Dataset for sales tax allocation.

Hegar, Glenn. Tax Exemptions and Tax Incidence: A Report to the Governor and the 89th Legislature. Texas Comptroller of Public Accounts, Jan. 2025, https://comptroller.texas.gov/transparency/reports/tax-exemptions-and-incidence/2025/96-463.pdf.

On page 1, readers can find the simple statement that exemptions pertaining to sales tax exemptions totaled $66.79 billion dollars for Fiscal Year 2025, Sept 1 2024 to Aug 31 2025. Approximately $20.84 billion for the local sales taxes.

Census Reporter. "State House District 109, TX." Census Reporter, n.d., https://censusreporter.org/profiles/62000US48109-state-house-district-109-tx/.

Provides data on Texas House District 109, including population, households, and demographics based on ACS 2019-2023 estimates.